If you’re importing slippers from overseas manufacturers or distributing slippers to retailers in your country, you need to know how insurance works for slipper shipments. In this guide, we’ll cover the types of insurance available, the common risks, what to consider, and best practices for insuring your slipper shipments.

1. Types of Insurance

When it comes to insuring your slipper shipments, there are several types of insurance coverage available. Each one is designed to cover different parts of the shipping process. It’s important to choose the right one for your supply chain needs, shipping volume, and transportation methods.

a) Marine Cargo Insurance

Marine cargo insurance covers goods shipped by sea. Although the name implies it’s only for maritime shipping, it also covers goods shipped by air, road, and rail. Since a large percentage of slipper shipments are moved internationally, marine cargo insurance is one of the most common types of insurance coverage used in this industry.

Coverage highlights:

- Loss or damage during shipping

- Coverage for both ocean freight and air freight

- Protection from natural disasters, theft, or damage from loading/unloading

Marine cargo insurance can be taken as:

- All-Risk Coverage: This is the broadest level of coverage and covers most risks unless they are specifically excluded.

- Named Perils Coverage: Only covers risks specifically listed in the policy (e.g., fire, collision).

b) Air Cargo Insurance

If your slippers are shipped by air, air cargo insurance will cover your goods against various risks. While air shipments can be faster, they still come with risks like damage during handling, changes in temperature, and potential delays.

Coverage highlights:

- Protects against loss, damage, or theft during air transport

- Compensation for delays (in some policies)

- May include provisions for temperature-sensitive materials (important if your slippers have temperature-sensitive components, such as memory foam insoles)

c) Freight Forwarder’s Liability Insurance

Freight forwarders are companies that handle the shipping and logistics of your slipper shipments. They are not the ones who physically transport the goods, but they are responsible for managing the transportation. Freight forwarder’s liability insurance covers you if your shipment is damaged due to the forwarder’s negligence. This could include things like poor handling, mismanagement of documents, or using the wrong shipping methods.

Coverage highlights:

- Covers errors and negligence by the freight forwarder

- May be required depending on your contract with the freight forwarder

d) Carrier Liability Insurance

Carriers (like trucking companies, rail, or sea freight carriers) typically have limited liability for the goods they transport. Their liability is often limited by weight, and in many cases, the compensation for lost or damaged goods may not cover the full value of your shipment.

Coverage highlights:

- Provides limited compensation for lost or damaged goods based on weight

- Not a full replacement for cargo insurance but offers some basic protection

e) Warehouse-to-Warehouse Insurance

This type of insurance covers your goods from the time they leave the manufacturer’s warehouse until they arrive at your distribution center. For slipper shipments, which may involve multiple legs of transportation (e.g., sea to truck delivery), warehouse-to-warehouse insurance provides coverage throughout the entire journey.

Coverage highlights:

- Covers all legs of the shipment journey

- Includes protection for storage in warehouses during transit

- Reduces gaps in coverage between transportation methods

2. Common Risks in Slipper Shipments

Understanding the common risks associated with slipper shipments will help you choose the right insurance and put the proper risk management strategies in place. Some of the most common risks include:

- Damage during transit: Slippers can be subject to rough handling during loading and unloading, especially if they are shipped in large containers.

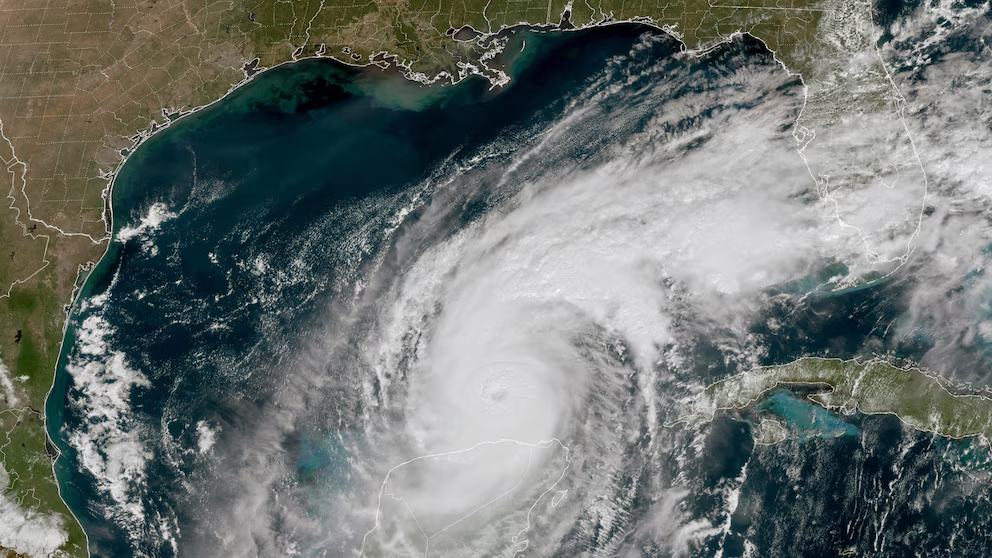

- Weather-related risks:Storms and other natural disasters can damage goods during sea or air transit, especially if the shipment isn’t adequately protected.

- Theft: Slippers can be a target for theft during transit, especially if they are shipped in bulk and stored in unsecured warehouses or transportation facilities.

- Customs delays: Delays at customs can lead to damaged goods, missed delivery deadlines, and additional costs, especially if you use perishable packaging materials (like eco-friendly boxes).

- Incorrect documentation: Poor management of shipping documentation can lead to delays, rejected shipments, or additional costs.

3. Key Points When Choosing Insurance

Choosing the right insurance for your slipper shipments is more than just picking the cheapest option. Several factors should be considered to make sure you get the coverage you need.

a) Value of the Shipment

Determine the total value of each slipper shipment, including production costs, transportation costs, and any other associated fees. Make sure your insurance covers the full value of the shipment, including any potential profit margins if necessary.

b) Mode of Transportation

The mode of transportation you use (air, sea, rail, or road) will affect the type of insurance you need. Sea freight often has different risks (like water damage) compared to air freight (where theft or rough handling may be more likely).

c) Geographic Considerations

When you ship slippers internationally, you have to deal with different geographic risks. For example:

- Some regions have higher piracy risks (e.g., certain maritime routes).

- Some regions are prone to natural disasters, which can damage your shipments through floods, earthquakes, or storms.

- Some regions have political instability, which can impact your shipment.

d) Frequency of Shipments

If you’re shipping slippers on a regular basis, you might want to consider getting an open cargo policy. This is a policy that covers multiple shipments over a set period (e.g., annually). It’s often cheaper than insuring each shipment individually.

e) Exclusions and Limitations

Read the fine print to see what risks are excluded from your policy. For example, some policies exclude losses due to improper packaging or specific natural disasters. Make sure your insurance policy covers all the key risks that are relevant to your slipper shipments.

5. Best Practices for Insuring Slipper Shipments

To make sure your slipper shipments are properly insured and protected, here are some best practices to follow:

- Work with a qualified insurance broker: An insurance broker who specializes in international shipping can help you find the right coverage for your shipments.

- Ensure proper documentation: Keep accurate and complete shipping documents. This includes invoices, bills of lading, packing lists, etc. These documents are critical in the event you have to file an insurance claim.

- Inspect shipments before and after transit:Inspect your slipper shipments before they leave your warehouse and after they arrive at their destination. This will help you identify any damage that may have occurred during shipping.

- Invest in quality packaging: Proper packaging can help reduce the risk of damage during shipping, especially if you’re shipping more delicate or higher-end slipper products.

- Review your policy regularly: As your business grows or as you start shipping slippers to new regions, make sure your insurance policy grows with you.

4. How to File a Claim

If your slipper shipment is damaged or lost, here’s how to file a claim to recover your losses:

- Document the damage or loss: Take pictures of any damaged goods and keep all records related to the shipment (e.g., delivery receipts, inspection reports).

- Notify your insurer immediately: Let your insurance company know as soon as you discover the damage or loss. Ideally, you’ll do this within the time frame specified in your policy.

- Submit all necessary documentation: Provide your insurance company with invoices, shipping documents, inspection reports, and any other required paperwork to support your claim.

- Follow up regularly:Insurance claims can take time to process. Be sure to follow up regularly with your insurance company to check on the status of your claim.

Conclusion

Insurance for your slipper shipments is an important part of managing risk for any buyer involved in retail supply chains. By understanding the types of insurance available, the risks involved, and the key things to think about when selecting a policy, you can make sure your business is protected from potential losses. Taking the time to invest in good insurance coverage can save you from costly disruptions and keep your slipper supply chain running smoothly.