Currency risk, also known as exchange rate risk, is when the value of currencies fluctuates when you’re doing business in foreign currencies. Those fluctuations can cause you to have unexpected cost increases or reductions in your profit margins.

Here’s a breakdown of what you can do to mitigate currency risk when you’re buying slippers from overseas.

1. Hedging Through Forward Contracts

One of the most common ways to mitigate currency risk is to hedge through forward contracts. A forward contract is a financial tool that lets you lock in an exchange rate for a future date. This is especially useful when you’re negotiating large orders or long-term contracts with your suppliers.

For example, let’s say you’re negotiating a big order of slippers from a supplier in China, and you’re going to pay them in U.S. dollars. You could lock in the current exchange rate between the Euro and the U.S. dollar for three to six months in the future when the payment is due. That way, even if the Euro weakens against the U.S. dollar during that time, you won’t have to pay more for the slippers than you originally budgeted.

2. Local Currency Transactions

A strategy many buyers new to international trade overlook is to negotiate with suppliers to do the deal in your currency (EUR). This puts the currency risk on the supplier, who may have better abilities to manage the fluctuations in their local market.

Keep in mind, some suppliers may charge you a premium to take on this risk. If you’re dealing with a supplier that operates in a stable currency environment, this may not cost you much more. On the other hand, if you’re dealing with a supplier in a more volatile region, they may increase their prices to compensate for the potential currency risk they are taking on.

3. Diversifying Suppliers

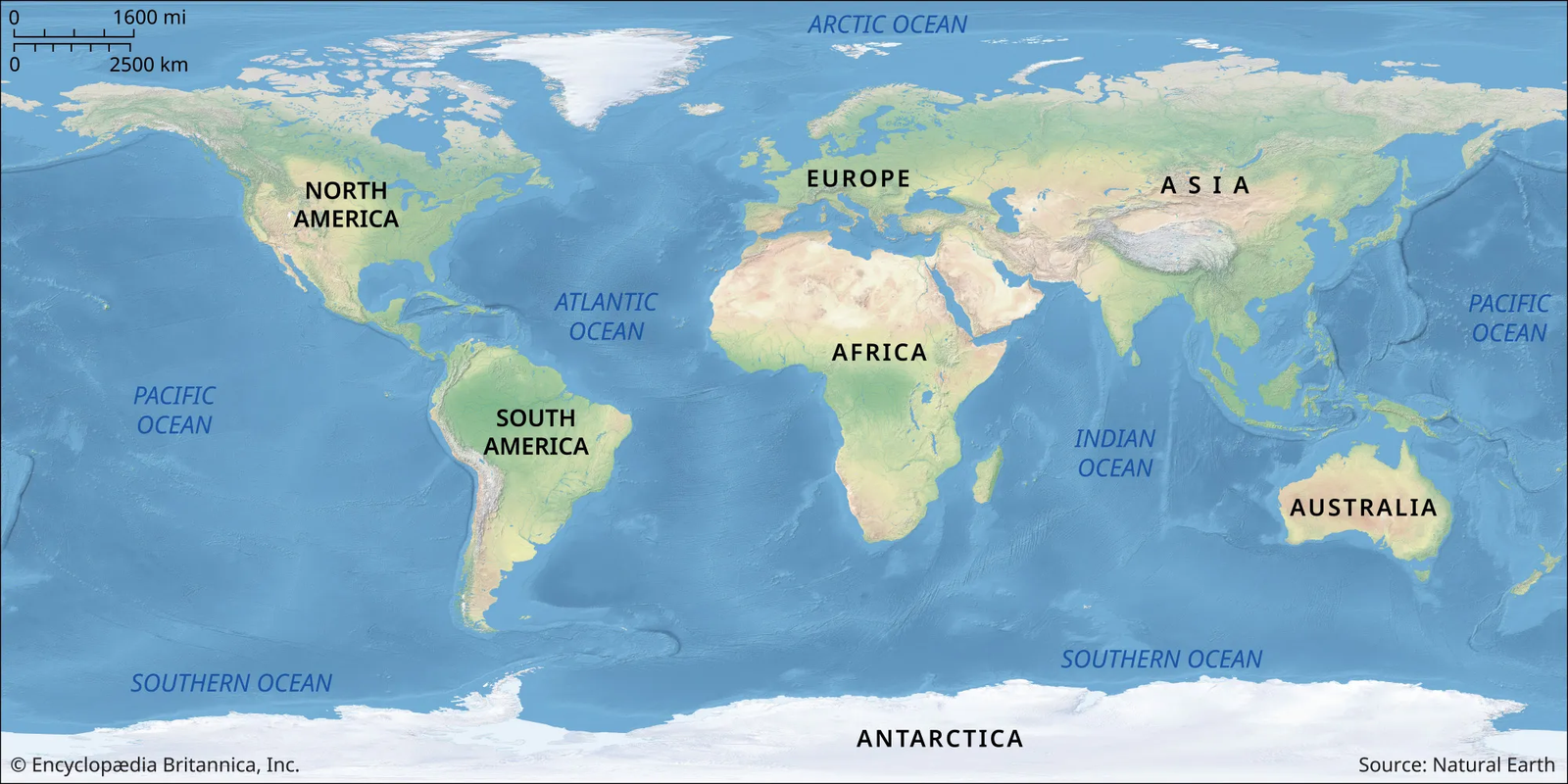

You can diversify your currency risk by working with suppliers from different countries. For example, instead of relying on a supplier in one country (like China where the transactions may be in USD or CNY), you could source slippers from multiple regions like Vietnam, India, or Turkey. This way, you spread your currency risk across multiple currencies, which reduces the impact of adverse fluctuations in any one currency.

This strategy also helps mitigate supply chain risks, as you’re not relying on a single country or supplier. However, managing multiple suppliers comes with its own challenges, including increased logistics and relationship management, but it can be a worthwhile approach to reduce overall risk.

4. Budget Buffer for Fluctuations

When you’re planning your budget for international purchases, you should build in a buffer for currency fluctuations. Currency volatility can cause prices to fluctuate significantly, and if you don’t have a buffer, you could get burned by sudden rate changes.

For example, if you expect to pay €10,000 for a shipment of slippers, you might want to budget an additional 5-10% to cover potential currency fluctuations. This buffer can help protect you from unexpected costs, especially if you’re dealing with more volatile currencies.

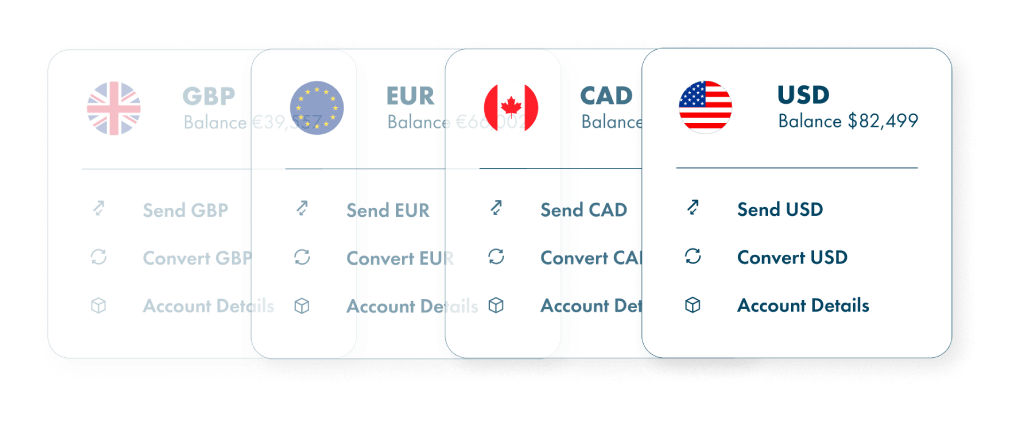

5. Using Multi-Currency Accounts

A multi-currency account allows you to hold foreign currencies in your account, so you don’t have to convert currencies as often. If you’re buying slippers from the same supplier all the time or in the same currency (like USD), having a USD account can help you manage the timing of your currency conversions. This is especially useful if you think the Euro is going to weaken against the USD over time.

For instance, you can exchange Euros for USD when the exchange rate is favorable and hold that currency until you need to make payments to your suppliers.

6. Monitoring Exchange Rates Regularly

Staying informed about currency trends and fluctuations is a simple but effective way to manage currency risk. By keeping an eye on exchange rates, you can decide when to convert currencies or place orders. Tools like currency alerts, which notify you when your desired rate is reached, can be helpful.

Also, pay attention to economic indicators like interest rate changes, inflation rates, or major political events that could impact currency values. By keeping an eye on these factors, you can anticipate currency movements and adjust your buying strategies accordingly.

7. Leverage Technology and Automation

Many digital tools can help you manage and mitigate currency risk. Fintech platforms that specialize in international payments, such as TransferWise (Wise), OFX, or Payoneer, offer features like real-time exchange rate tracking, forward contracts, and options at competitive rates compared to traditional banks.

By integrating these tools into your purchasing process, you can streamline your payments, manage multiple currencies, and set up alerts for when exchange rates are favorable. Automating these tasks can reduce the administrative burden and help ensure you take advantage of favorable market conditions.

8. Fixing Pricing with Suppliers

Finally, another way to mitigate currency risk is to lock in prices with your suppliers for a specific period of time. By negotiating fixed pricing for a certain number of orders or months, you can have cost certainty, which can help you budget more effectively and protect against currency fluctuations.

Keep in mind that suppliers may be hesitant to fix prices if they think the currency is going to be volatile. However, if you have a long-term relationship with a supplier or you’re placing larger orders, you may have more leverage to get your supplier to agree to fixed pricing.

Conclusion

Currency risk is a reality of international trade, but as a buyer, especially when you’re starting out, you have several strategies to mitigate your risk. Using tools like forward contracts, currency options, and multi-currency accounts, negotiating transactions in your currency, and working with financial experts are practical steps you can take to protect your margins when you buy slippers from overseas.

Taking the time to implement these strategies will help you make better buying decisions and manage your procurement costs in a volatile currency market.