Forewared: Importing slippers from China is a great opportunity if you’re in the B2B space. China has a lot of production capabilities, and it’s cost effective. However, you have to understand the tariffs, regulations, and compliance issues so you can have a smooth transaction and not get your imports confiscated by customs. In this article, I’m going to give you a detailed guide to help you understand the tariffs and regulations when you import slippers from China into the European Union (EU), specifically Germany.

1. Understanding Import Tariffs for Slippers from China

When you import slippers from China, you need to know about the tariffs. Tariffs can significantly impact your costs. Tariffs are taxes the government imposes on imported goods. They are usually a percentage

of the value of the goods. In the case of EU countries like Germany, the tariffs are the same for all countries. There are specific rates for different kinds of products, such as slippers.

a. Customs Duty (Tariff Rates)

The customs duty rate for slippers varies depending on the type of slipper, materials used, and whether they are for men, women, or children. For most footwear, including slippers, the duty rates can range between 10% and 17%. Here are some common categories and associated tariff rates:

- Leather Slippers: The duty rate for slippers made of leather is generally around 8-12%.

- Rubber/Plastic Slippers: For slippers made from synthetic materials such as rubber or plastic, the rate is usually between 6-8%.

- Textile Slippers: Slippers made of textile materials, such as cotton or polyester, can face duty rates from 5-12%.

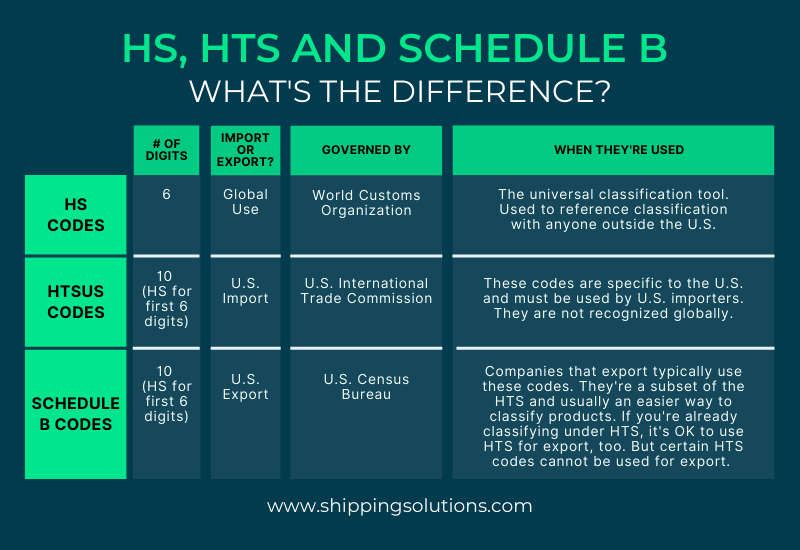

You can determine the exact tariff rate for your product by using the Harmonized System (HS) Code, a standardized coding system used internationally. For slippers, the typical HS Code is 6405, which covers footwear with outer soles made of rubber or plastic.

b. Calculating Tariff Costs

To calculate your tariff costs:

- Determine the value of your goods: This includes the cost of the slippers and any insurance or shipping costs (CIF – Cost, Insurance, and Freight).

- Apply the tariff rate: Multiply the value of the goods by the applicable tariff rate (e.g., 10% for rubber slippers).Example:

If you’re importing slippers worth €10,000 with a 10% tariff rate, the customs duty would be €1,000 (€10,000 x 10%).

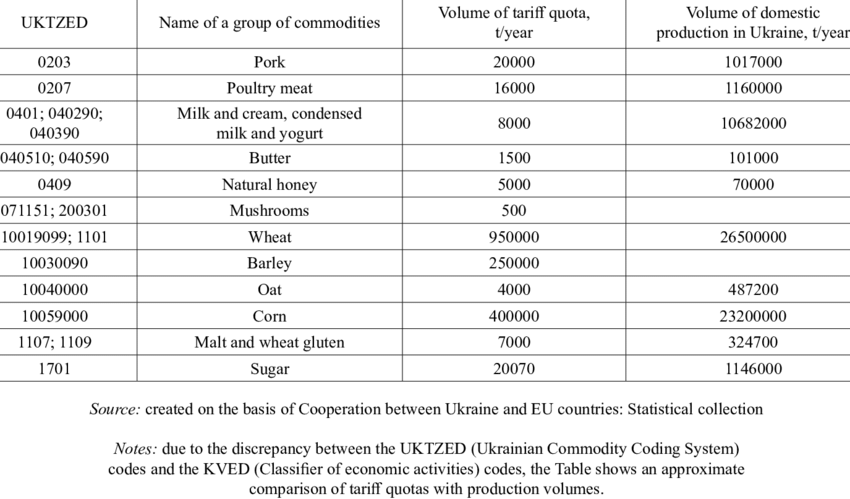

c. EU Tariff Quotas

The EU has tariff quotas. This means you can bring in a certain number of a particular thing at a reduced tariff rate. You need to check if slippers from China are on the list of things you can bring in at a lower tariff rate. This changes every year, so you need to check the EU’s TARIC (Tariff and Integrated Community System) database regularly to see what’s on the list.

2. VAT (Value-Added Tax)

In addition to customs duties, importers in Germany must pay VAT on goods imported from outside the EU, including China. The VAT rate in Germany is 19%, though a reduced rate of 7% may apply in some cases, depending on the specific product.

VAT is calculated on the total cost of goods, which includes the CIF value, the customs duty, and any additional fees like inspection or port charges.

Example Calculation:

- CIF Value of slippers: €10,000

- Customs Duty (10%): €1,000

- Total cost before VAT: €11,000

- VAT (19% of €11,000): €2,090

So, the total cost after VAT would be €13,090.

3. Import Regulations and Standards for Slippers in the EU

Besides tariffs, it is essential to ensure that the slippers you import comply with European Union regulations. Germany, as part of the EU, follows strict guidelines on product safety, labeling, and material composition.

a. Product Safety and CE Marking

Footwear, including slippers, must meet EU safety standards. Although slippers may not require CE marking (which is usually reserved for electronic goods or safety-critical items), they must comply with general product safety regulations (GPSR). This ensures that the slippers are safe for consumer use and are free from harmful chemicals.

Key regulations include:

- REACH Regulation: This EU regulation focuses on the registration, evaluation, authorization, and restriction of chemicals. Slippers must not contain dangerous substances like lead, cadmium, or certain phthalates (commonly found in plastics). Importers are responsible for ensuring compliance with these chemical standards.

- General Product Safety Directive (GPSD): This directive ensures that products placed on the EU market are safe. Slippers must be free from sharp edges, not present a choking hazard, and must be durable enough for their intended use.

b. Labeling Requirements

Clear labeling is a regulatory requirement in the EU. All slippers imported into Germany must meet specific labeling guidelines, including:

- Material Composition: The label must indicate the materials used for the upper, lining, and outer sole of the slipper (e.g., leather, textile, rubber).

- Country of Origin: You must indicate that the product is made in China.

- Size Information: The European shoe sizing system should be clearly displayed.

- Safety Labels: If the slippers contain small parts that may pose a hazard to children, appropriate warning labels are required.

Failure to comply with labeling regulations can result in customs holding your shipment or penalties.

4. Customs Clearance Procedures

Understanding customs procedures is essential to avoid delays and additional costs. Germany follows the EU-wide customs clearance process, which includes several steps:

a. EORI Number

Before importing goods into the EU, you must obtain an Economic Operators Registration and Identification (EORI) number. This is a unique identification number used by customs authorities across the EU to track and process imports.

b. Customs Declaration

When your shipment of slippers arrives in Germany, you must submit a customs declaration. This can be done electronically via the Automated Import System (AIS), which is part of the European Union’s customs systems. The declaration should include details such as the value of the goods, tariff classification (HS code), and the origin of the goods.

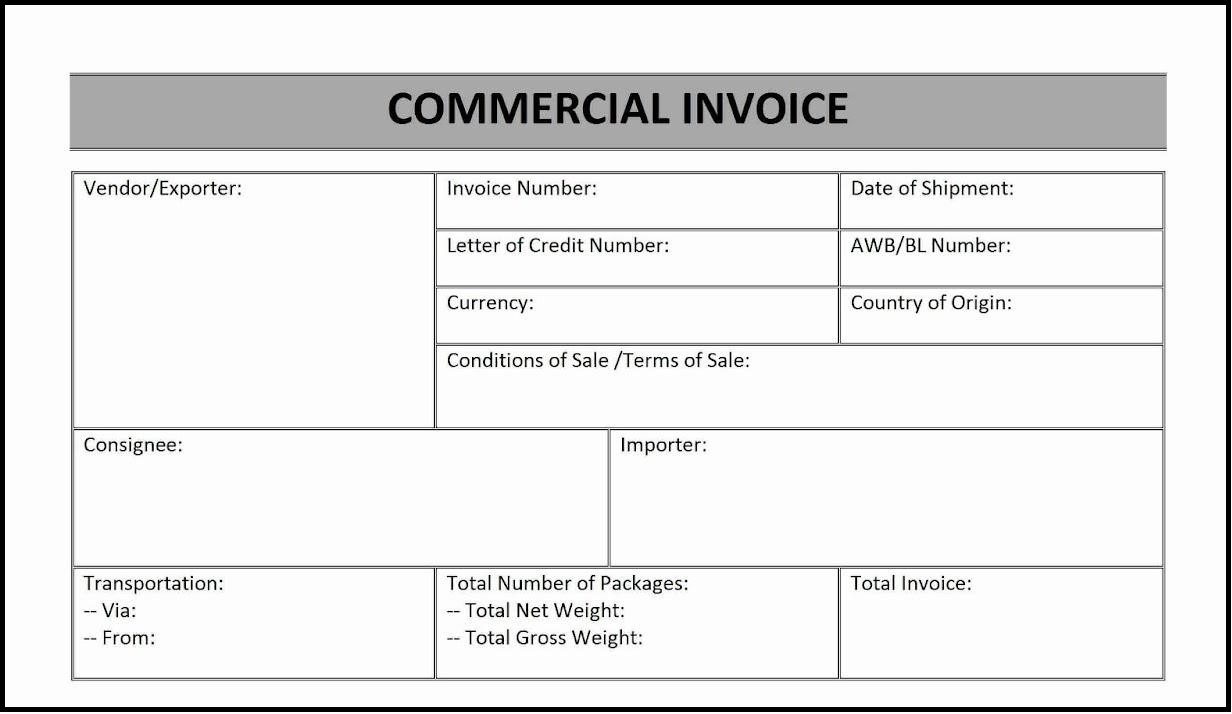

c. Documentation Required

To ensure smooth customs clearance, you’ll need to provide several documents, including:

- Commercial Invoice: This document details the value, quantity, and description of the slippers.

- Packing List: A detailed list of the goods, including their packaging and weight.

- Bill of Lading or Airway Bill: Proof of shipment.

- Certificate of Origin: Though not always mandatory, this document can help with tariff reductions if trade agreements are in place.

5. Trade Agreements and Tariff Reductions

China and the EU do not have a free trade agreement (FTA), which means there are no significant reductions in tariffs when importing from China. However, monitoring trade negotiations is important, as future agreements may reduce tariffs on certain goods, including slippers.

Additionally, if your slippers are produced in other countries with whom the EU has preferential trade agreements (such as Vietnam), you may be eligible for reduced tariffs under rules of origin provisions.

6. Logistics and Shipping Considerations

Finally, understanding logistics is crucial to ensure timely delivery and cost-efficiency. When importing from China, you’ll need to choose between sea freight and air freight.

- Sea Freight: Best for large shipments of slippers, though it takes longer (typically 4-6 weeks). Costs are lower than air freight, but you’ll need to factor in port fees and container costs.

- Air Freight: Suitable for smaller, urgent orders, but more expensive. It’s much faster, typically taking 7-10 days.

Conclusion

Importing slippers from China into Germany is a great opportunity for your business. However, you need to know the tariffs, VAT, customs procedures, and EU regulations so you can do it right. If you understand

the tariffs, make sure you are in compliance with the safety standards, and have the right paperwork, you can make the process go smoothly and avoid costly delays. Always consult with customs experts or legal

advisers to make sure you are in compliance and to stay up-to-date on any changes to the trade regulations or tariffs.